What is the point of further using ATMs, especially in a payment environment that many say is becoming increasingly less reliant on cash? We answer that question in this article by first acknowledging that there are myths in payments.

Take, for example, the myth that the future is forsaking cash through cashless policies. Outrageously, cash is going away altogether. After all, the storyline goes, as mobile payments gain steam, they are preparing to completely remake the payments experience, killing the use of cash in the process. Well, what if we told you consumers are not looking for the payment experience to be remade?

Cash Use Still Strong Even Among The Futuristic

Despite access to a variety of payment methods, plenty of consumers continue to prefer cash for reasons such as budgeting, security or perhaps simply the feeling of having a little spending money in their pockets.

According to recent studies, cash at 40 percent of all consumer transaction activity is the most used retail payment instrument.

Ready for the real myth buster? A diverse group of consumers, particularly younger consumers, prefer and use cash. Also according to the latest research, 40 percent of 18 to 24-year-olds prefer cash, the highest percentage of any age group, demonstrating that cash continues to play a fundamental role in payments, even for the digitally savvy younger generation.

Cash doomsayers are looking at the payments industry from a limited viewpoint. They are focused on the technology, not the consumer. Consumers have shown us time and time again that when you provide a service they value, they come and they use it.

The real opportunity offered by mobile technology

Now, that said, just because consumers are not looking for the payment experience to be remade does not mean that smartphones, retailer loyalty apps and mobile payments are not changing the game for ATM owners and operators.

New technology can help us realize an environment in which ATMs are even more valuable to the consumer, beyond being convenient access points for cash.

Consider this: Consumers are increasingly aware of and frustrated by the fees they pay. Even in an era of increasing convenience for the consumer, many banks still charge a foreign fee to their customers when they use retail ATMs. If fees reduce the convenience factor of a retail ATM, then the question becomes how to make the ATM either more cost effective or otherwise more valuable to the consumer as a part of a holistic experience.

By taking full advantage of opportunities offered by mobile devices and location services technology, for example, we can enable the consumer to find a surcharge-free ATM based on their current geographical location. Or, we as an industry can enable ATM-exclusive promotions — in-store discounts, links to retailer loyalty programs and digital coupons delivered to the mobile phone. Aided by mobile technology, the ATM can be central to deeper engagement in the environment where the ATM user is choosing convenient access to cash.

ATM trends

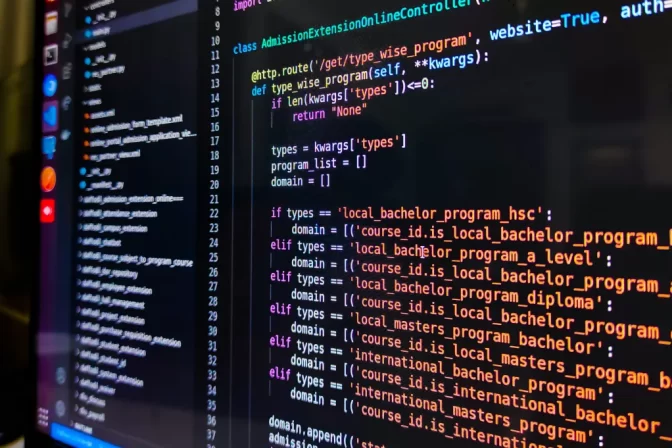

The world of ATM banking is undergoing huge changes, with mobile payment methods and cardless technologies taking charge. Leading players like NCR and Diebold are redesigning their ATMs to keep pace with the changing needs and services. NCR has come up with innovations such as the screen free Cash Barrel for cash withdrawal, Tower with no interface console and Motion Sensor which offers a touchless interface. Not to be outdone, Diebold has unveiled its Janus dual-sided self-service channel.

Other innovations in the ATMs include:

Cash recycling: This enables an ATM to accept, validate, sort and store banknotes. It is estimated that banks can save 40 to 66 % on cash-handling costs through cash-recycling ATMs. Cash recycling is fast becoming a norm across markets.

Talking ATMs: Speech capability for visually challenged customers.

Video ATMs enable customers to interact visually on an ATM with “live” bank tellers in remote locations.

Smart ATMs provide cardless access to ATM services and could use biometric authentication. These ATMs can also memorize consumer preferences based on past transactions and behavior, and thus tailor their services.

Multi-channel solutions like NCR Connections, which is based on modern web technology and can be easily integrated into a variety of physical and digital channels (ATM, Kiosk, Tablet, Web etc.).

ATMs with cloud-based machine learning services and tools help organizations transform their connected assets and the data they produce into business intelligence, for example, Diebold has partnered with Microsoft to use the Cortana Analytics Suite.

Automated bank branch ATMs: There are ongoing efforts to integrate robotics and artificial intelligence systems into self-service banking. MonRo (money robot), a self-service robotic system, provides an imaginative hybrid of an ATM – currency exchange, vending machine, safe deposit boxes, storage and retrieval services, and coin and gold bullion.

Beacon-enabled ATMs allow customers to access ATM lobbies without the need for a card. The beacons are also used to send personalized, location-based messages to customers.

From the point of view of the customers, ATMs are still an important contact point for a bank-customer relationship. Concurrently, bank customers expect more from the available ATM services. Therefore, banks have to reinvent ATM as a fully integrated channel within an Omni-channel strategy.

Taking all these points into account, we would vote for a big future for cardless ATM transactions, huge increases in ATM biometrics and cash-recycling ATMs. Just around the corner, we believe, is a new golden era for the ATM as a core payments hub in a reconfigured banking and consumer landscape.

Credit: www.worldcore.eu